Magasin ouvert le samedi 8 mai : Intermarché, LIDL, Leclerc, Auchan, Monoprix, Carrefour, …

Découvrez la suite de notre article sur les magasins ouverts le 1er mai, les magasins ouverts le 13 mai et les magasins ouverts le lundi de Pentecôte : quels sont les magasins ouverts le samedi 8 mai ? Le 8 mai est un jour férié et certaines enseignes sont fermées. Si vous souhaitez profiter de ce jour pour faire des achats ou du shopping, découvrez sans plus attendre la liste des magasins ouverts en mai. Vous saurez ainsi dans quelle grande surface (supermarché ou hypermarché) vous rendre pour faire vos achats. Vous éviterez ainsi tout déplacement inutile! Liste des magasins…

Quelle est la différence entre une carte bleue et une carte visa ?

Dans l’univers des services bancaires, il existe un grand nombre de cartes bancaires, qu’elle soit de crédit ou de débit. Cependant, dans le langage commun, elles sont regroupées sous l’appellation de Carte bleue. Il est donc possible de se poser…

Pourquoi est-ce que ça s’appelle une « carte bleue » ?

Vous le savez sans doute déjà, la carte bleue est la dénomination commune utilisée par les Français pour désigner leur carte bancaire. Cependant, loin d’être anodine, cette appellation a une place importante dans l’histoire de la carte bancaire. On vous…

Comment simuler le bonus écologique pour véhicules ?

Si le bonus écologique est l’aide étatique à l’acquisition de véhicules qui attire toutes les attentions, très peu savent comment cette dernière fonctionne et encore moins s’ils y sont éligibles. Sachez qu’il s’agit d’un accompagnement sous forme de prime, dont…

Quels sont les différents types de cartes bancaires ?

La carte bancaire est une passerelle permettant un accès facile entre vous et votre compte bancaire traditionnel ou en ligne. Et vu leur utilité, on y rattache communément le terme « carte de crédit ». Ce n’est pas tout à…

Peut-on faire plusieurs offres d’achat immobilier ?

Vous êtes investisseur ou tout simplement un particulier à la recherche d’un logement ? Sachez que dans votre recherche, il peut arriver que les offres qui se présentent à vous ne vous conviennent pas du tout. Il peut également arriver que…

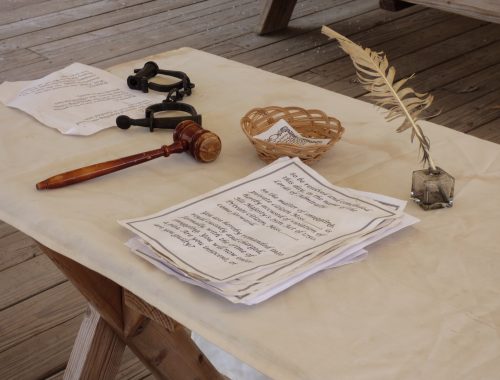

Acte de naissance : combien de temps pour l’obtenir ?

L’acte de naissance est un document établi lors de la déclaration de naissance de tout individu dans les trois jours suivant sa naissance. Il s’agit donc d’une preuve valable de l’identité de la personne tout au long de sa vie.…